I am a software developer who began developing a passion for investing in 2021. YouTube's recommendation system suggested a couple of value investing books to read. That basically got me started. Even though I had no financial education before 2021, I learned about value investing by reading books, watching videos of well-known value investors and through social media (WeChat value investors group, Twitter etc.). Over the last three years, I have read a lot, learned a lot, made some mistakes, but also achieved multi-baggers in $PDD, $META, $FFH.TO, $HFG.DE, $1810.HK and 3 other small-caps stocks.

I'd like to bring my programming skills to equity research and continuing practising value investing. What initially inspired me was the opportunity to achieve financial freedom. Additionally, I am motivated by the contrarian approach buying the dip when stocks like $META, $PDD, $HFG.DE were crashing 80-90%, or investing in $FFH.TO when its stock price remained stagnant between 2015 and 2021. I also enjoy being one of the first to discover and write about an undiscovered micro- or small-cap stock on my Twitter or blog.

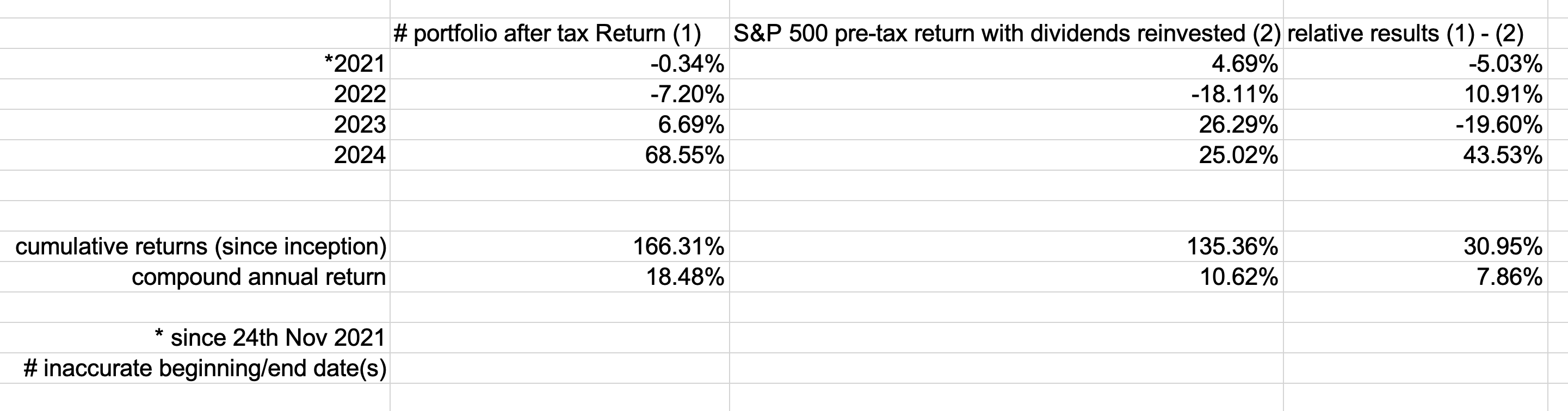

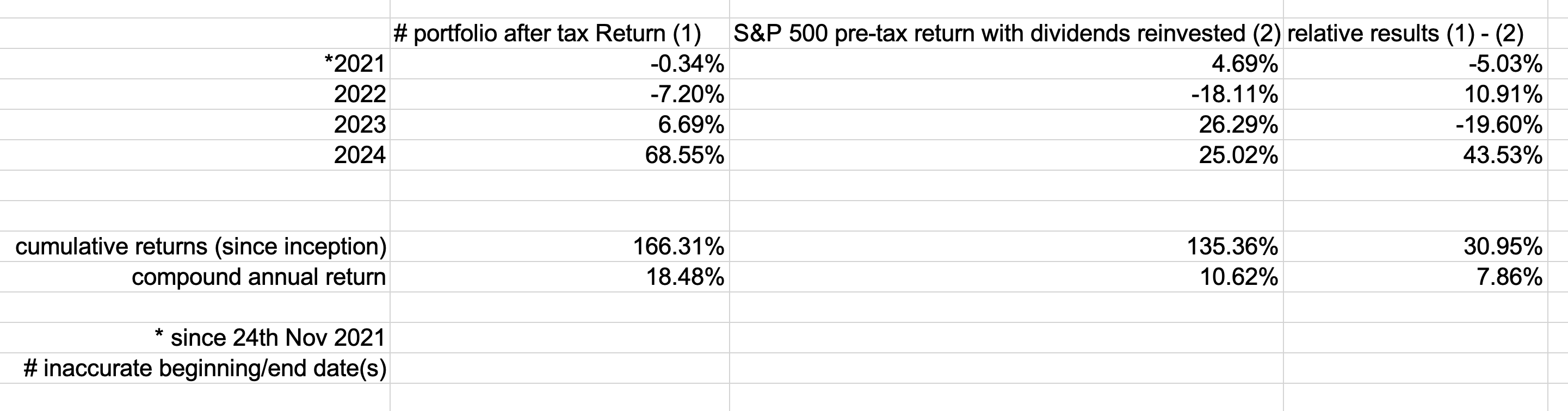

After underperforming the market between 2021 and 2023 because over-diversification, I decided to visit the Berkshire annual meeting in May 2024, and concentrate on 1-3 core positions and sold out a couple of stocks that either were fairly valued or overvalued or simply I don't know enough about.

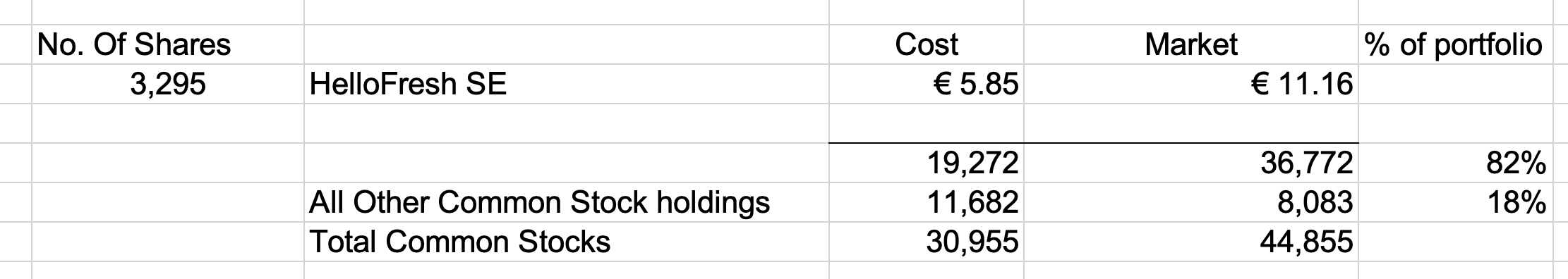

Below, you can check out the 2024 year-end net holdings in marketable equities. All positions with a market value over €5000 are listed.

Software Engineer Dec 2018 - Sept 2025 - Frankfurt/Munich/Remote

University of Giessen, B.S. in Economics, 10/2025 - Present

University of Ulm, M.S. in Software Engineering, 10/2016 - 10/2018

University of Ulm, B.S. in Computer Science, 10/2011 - 10/2015

English (fluent), German (business fluent), Chinese (fluent)

part-time long-term investing since Nov. 2021 in